2003

Shipbuilding

• Increase emphasis of manufacturing higher value vessels

• Expanding and enhancing the existing tug boat and barge manufacturing operations

Chatering

• Shipping of commodities and raw materials

• Indonesia remains the Group’s main market for vessel chatering activities

Prospects

• Increase enquiries and orders from new vessels and chatering services.

2004

Shipbuilding

• Revenue of shipbuilding 61%

• Focus to building vessels of larger capacity and higher specification

Chatering

• Lower revenue due to costs of conversion and modification to several vessels in the fleet in preparation for long term charter to foreign customer

Prospects

• Demand for small and medium size offshore support vessels is on the rise

• Concentrate on building more of such vessels to cater the demand

• Aim to benefit coal transportation business in Indonesia (main source for M’sia)

Friday, July 30, 2010

NTPM analysis 2009

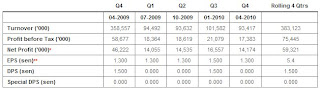

From NTPM financial statement result, it showed a consistence result over 6 years (from year 2004 to 2009) with average ROE 18%.

From the above financial statement,

But like this type of company, competition is very fierce, so the cost management must be good. So far NTPM is still doing a good job on that. I believe NTPM is a good company to invest in long term basic but however the return of your investment is depending on the price you invest.

For the current price 58.5 cents with last quarter result 1.3 cents, which give PE 11.25

- Revenue is growing getting faster from 7.5% (2005) to 17.1% (2009)

- Advertising expenses maintain at 2%

- Raw materials & consumables used maintain around 36.3% to 38.8%

- Repairs & Maintainance expenses slightly increase from 2.9% (year 2004) to 3.3% (2009)

- Employee benefits expense is getting less with 16.7% (2004) to 15.2% (2009)

- Sundry wages maintain at 0.6%

- transportation and freight charges maintain around 5.8% to 6.4%

- Utilities Costs maintain at around 6.3% to 6.6%

- Financial Costs reduce from 1.1% (2005) to 0.6% (2009)

From the above financial statement,

- We can see that Raw Materials costs, Transportation cost and utilities costs are maintained at at flat percentage, which means NTPM has the power to pass the cost to the customer.

- Revenue grow means its market is getting bigger.

- Employee expenses and financial costs are getting less means the management is very efficiency and able to use well in manpower.

But like this type of company, competition is very fierce, so the cost management must be good. So far NTPM is still doing a good job on that. I believe NTPM is a good company to invest in long term basic but however the return of your investment is depending on the price you invest.

For the current price 58.5 cents with last quarter result 1.3 cents, which give PE 11.25

NTPM 2009

The group principally involved in the manufacturing and trading of paper-related products, trading if cotton-related products and investment holding.

Market:

60% of tissue paper in Malaysia, products brand are PREMIER, CUTIE, ROYAL GOLD

40% Toilet roles in Malaysia, product brand is PREMIER

10% Sanitary napkins, product Brand is INTIMATE

Major Competitor is Kimberly Clark, which products are under brand name KLEENEX and SCOTT.

The improvement in Group's profit for the financial year 2009 was due to increase in sales , softening of some comodity prices and improvement of operation and distribution efficiencies.

Tissue products

Sales of tissue grew by 16%

Export demand increase by 21% due to stronger foothold in the Oceania and USA and making inroads to countries like Vietnam and Nepal.

Sanitary Napkins

Sales grow 17% with the product brand INTIMATE, DIAPEX.

Souce: NTPM Holding Berhad annual report 2009

Thursday, July 29, 2010

Rce Capital Bhd @ 29july2010

RCECAP is currently involved in the provision of financing to government servants through the Salary Deduction Scheme and factoring services. During FY09, the loan financing business was the main activity for the group, which accounted for 94% of the group PBT.

Customer: Government servants which have the huge market potential.

Pros:

Cons:

Customer: Government servants which have the huge market potential.

Pros:

- Using salary deduction scheme which is very low risk for rcecap as rcecap will automatic receive loan payment from government servants, so which mean the possibility to get bad debt is low unless the government servants suddenly quit their job.

Cons:

- It is not like commercial banking system use saving account money (low interest) to borrow to people. Its capital source is through bond or loan from other place (high interest). So it means it have to charge higher interest on government servant, which i think in long term, when government servant start to realise it, then will stop to borrow money from it.

- From now, Rcecap is half monopoly this government servant market because commercial bank yet to get the license to enter this market, but what if the government start to re list new license? It definitely will hurt its business as commercial bank can provide cheaper interest rate.

Wednesday, July 28, 2010

Free & useful website to search for dividend information

This is a free website from icapital for you to search for dividend information, it is helpful..

Everytime you click, it will come out the latest dividend information for you, if you want to look at certain stock, you might just enter the stock name to search about it, as simple as that..

There are two version:

English http://icapital.biz/english/dividenddisplay2.asp

Chinese http://icapital.biz/chinese/dividenddisplay2.asp

Hope it is helpful for you all.

Alam Maritim Resources Bhd @ 28july2010

Alam Maritim Resources Bhd, is an integrated offshore service provider mainly involve in provision of marine transportation support services, offshore facilities construction and installation, underwater and sub-sea engineering services to the upstream activities in the oil and gas industry.

It lastest quarter result, 31/3/2010, showed that the revenue is down to 66.78 million from 93.73 million due to lower revenue registered by underwater services & offshore installation construction segment. However PBT increase due to higher margin.

Its major client is PETRONAS which contribute 60% revenue of Alam.

Pros: Oil & Gas future, relationship with PETRONAS

Cons: 7 years companies (5 years listed in Bursa), relationship with PETRONAS, debt very high (always borrow money to extend its business), market price is not attractive yet.

Things to look on: Cash Flow, debt

3 years ROE 22%

Current share price RM 1.25

PE 7.27 based on last quarter

PE around 6 based on EPS 20.8 (5.2 x 4)

Next quarter result will be announced on 19/8/2010.

Remarks: wait for next quarter result first.

Tuesday, July 27, 2010

Why we should not buy investment link insurance product beside pure insurance product..

I would like to say buying insurance is essential in nowadays, but definitely not investment link insurance product! WHY??

The reason is very simple, if you buy investment link insurance product, you are actually buying two products in a single package, there in order meaning, you are paying two commission for each product (Insurance agent should be more happy about that).

If you know how to invest, my advice is just buy the pure insurance enough, and the other extra cash you use to invest yourself by generating more income.

But however, investment link insurance product is good for those people who lazy and do not how to invest. It can safe guard the those people' money as well as to create a discipline to force them to save the money.

The reason is very simple, if you buy investment link insurance product, you are actually buying two products in a single package, there in order meaning, you are paying two commission for each product (Insurance agent should be more happy about that).

If you know how to invest, my advice is just buy the pure insurance enough, and the other extra cash you use to invest yourself by generating more income.

But however, investment link insurance product is good for those people who lazy and do not how to invest. It can safe guard the those people' money as well as to create a discipline to force them to save the money.

Wednesday, July 21, 2010

Stock @ 21/7/2010

Have some update here:

Sold Genting 500 shares at RM 7.49 @ 19/7/2010 (profit RM 512.15)

Bought Coastal 4,000 shares at RM 2.33 @ 19/7/2010

Bought Rcecap 15,000 shares at RM 0.65 @ 20/7/2010

Thursday, July 8, 2010

Why should we invest our own rather than invest in mutual fund?

There are some disadvantages restrictions impose on the mutual fund investment action like equity exposure generally range from 75% to 95% of its NAV (Net Asset Value). So it means when the economy in down turn, the fund no matter how needs to invest atleast 75% of its NAV in stock market. It is the same as at most 95% in the stock market when economy is going up. This rule definitely will restrict the performance of the fund and it makes the fund performance almost in line with the KLCI benchmark.

Mutual fund normally will charge the investor a 5.5% service charge and 1.5% management fee. What does this mean?

It means your hard earn money before put into the investment and get the fruitful return, there is 5.5% of your money already gone. And within the whole financial year, they will charge you another 1.5% yearly management fee (will be divided on daily basis) no matter they help you make any return or not. So total 7.0% burn already without any reason. For the 7.0% burn, your fund must make atleast 7.53% return to cover back your initial investment capital. Yes! Believe me! There is 7.53%!

If another guy B put the same amount of the capital into fixed deposit and the return is 3%. Then that’s mean that guy, B return is outperformed the previous guy, A 10.53% without any risk!!

Mutual fund is too over diversify, normally they invest around 30 to 50 stocks at one time. It is less chance for them do have a bad performance relative to KLCI index in a single year so as well as good performance.

The mutual fund managers are paid consistently no matter how the funds perform. It is unfair for a person to receive a good pay but doing a moderate job.

However there are mutual fund managers do a very good job in the investment field and did bring a good return for investor, so if you want to invest in mutual fund, please think about the pros and cons and put your money only with those capable fund managers.

Mutual fund normally will charge the investor a 5.5% service charge and 1.5% management fee. What does this mean?

It means your hard earn money before put into the investment and get the fruitful return, there is 5.5% of your money already gone. And within the whole financial year, they will charge you another 1.5% yearly management fee (will be divided on daily basis) no matter they help you make any return or not. So total 7.0% burn already without any reason. For the 7.0% burn, your fund must make atleast 7.53% return to cover back your initial investment capital. Yes! Believe me! There is 7.53%!

If another guy B put the same amount of the capital into fixed deposit and the return is 3%. Then that’s mean that guy, B return is outperformed the previous guy, A 10.53% without any risk!!

Mutual fund is too over diversify, normally they invest around 30 to 50 stocks at one time. It is less chance for them do have a bad performance relative to KLCI index in a single year so as well as good performance.

The mutual fund managers are paid consistently no matter how the funds perform. It is unfair for a person to receive a good pay but doing a moderate job.

However there are mutual fund managers do a very good job in the investment field and did bring a good return for investor, so if you want to invest in mutual fund, please think about the pros and cons and put your money only with those capable fund managers.

Monday, July 5, 2010

How the compound interest works?

Below is an example of the annual compound rate of return that will give you some idea how it works and how it bring a great fortune in your future life.

As you can see from the table above, annual compound rate of return makes the different and the time help you to run your fortune. If the rate of return is low, no matter how long you invest it, it also cannot bring any fortune for you. The best example of the 4% annual compound rate of return is fixed deposit which is offered by our banking system.

As you can see from the table above, annual compound rate of return makes the different and the time help you to run your fortune. If the rate of return is low, no matter how long you invest it, it also cannot bring any fortune for you. The best example of the 4% annual compound rate of return is fixed deposit which is offered by our banking system.

Thursday, July 1, 2010

What are the products that can let a company earn a lot of money?

The products must have the characteristic as below:

1. The products must be used in daily life,

2. The products must be repeated use in daily life,

3. The products cannot be re-use, and

4. The products must be special enough and other company's products cannot replace it.

If a company own the products that have the characteristic i mention above, this is the company we need to invest and hold its share forever..

1. The products must be used in daily life,

2. The products must be repeated use in daily life,

3. The products cannot be re-use, and

4. The products must be special enough and other company's products cannot replace it.

If a company own the products that have the characteristic i mention above, this is the company we need to invest and hold its share forever..